Breaking Ceilings

Like any industry, banking has long-established practices and policies that are inadvertent obstacles to progress. The Federal Home Loan Bank System is reviewing its lines of business for rules and processes that negatively impact diverse communities — and using its unique position within the banking ecosystem to tear down those barriers. Read the Stories

Tangled Property Titles Inhibit Generational Wealth

FHLBank Atlanta rallies members to develop solutions to heirs’ property challenges.

Homeownership is etched into the American dream, and often passed down through generations. Yet for a shocking number of families, that dream is clouded by heirs’ property challenges. Heirs’ property occurs when a property owner dies with a will that leaves property to multiple beneficiaries, or in the absence of a will, the property is passed by law to descendants, which results in a “fractured or tangled” title. Through an aggressive awareness campaign, a funding forum and a $1 million grant, the Federal Home Loan Bank of Atlanta (FHLBank Atlanta) is inspiring solutions nationwide, especially in the Southern Black Belt region, where an estimated 41 percent of Black-owned land is heirs’ property.*

“These properties are entangled through the lack of a clear title, which impacts everything,” explained Arthur Fleming, Senior Vice President and Director of Community Investment Services for FHLBank Atlanta. “Without a clear title, the property occupant can’t sell it, can’t lease it, can’t leverage the property for loans — they can’t do anything with it. It generally becomes blighted property. Generational wealth challenges, the minority homeownership gap and poor and blighted neighborhoods can all be positively impacted if we collaborate to solve the heirs’ property issue.”

Since 2019, FHLBank Atlanta has been raising awareness of the issue and its disproportionate effect on low-wealth families and racial and ethnic minority communities in rural and urban markets. In December 2021, the Bank reached out and joined with three other Federal Home Loan Banks (Boston, Dallas and Pittsburgh), the Federal Reserve Bank of Atlanta, the Federal Reserve Bank of Richmond and the Asset Funders Network to host the Heirs’ Property Prevention and Resolution Funders’ Forum. During the event, 40 potential funders consisting of banks and philanthropic organizations heard pitches for 84 pilot initiatives from 22 states, all designed to deliver scalable solutions to heirs’ property challenges.

FHLBank Atlanta’s efforts have produced a ripple effect of increased awareness and additional funding.

“Generational wealth challenges, the minority homeownership gap and poor and blighted neighborhoods can all be positively impacted if we collaborate to solve the heirs’ property issue”

— Arthur Fleming, Senior Vice President and Director of Community Investment Services, FLHBank Atlanta

The Truist Framework

“FHLBank Atlanta really heightened awareness of the challenge and how many billions of dollars are just sitting there that people don’t have access to,” said Anthony Weekly, Executive Vice President and Chief Community Reinvestment Act (CRA) and Community Development Officer at Truist Bank. In Georgia alone, $34 billion worth of tax-appraised property is likely heirs’ property, estimates the Georgia Heirs Property Law Center.

Truist became a partner of the Center in January 2021. It has since developed a web-based application to identify heirs’ properties, built checklists for heirs’ issues, created tools to automate processes for Center clients and provided the pro bono services of Truist Legal Department members.

Truist’s next step is to build funding for heirs’ property initiatives into its CRA program for the upcoming 2023–2025 exam schedule. It also plans to host an Estate Planning “Signing Day” event in Atlanta during the first quarter of 2023.

BankUnited’s Community Approach

FHLBank Atlanta also rallied BankUnited of Miami Lakes, Florida, to address the pervasive problem. Eric Hibbert and Angelica Coronel, who manage BankUnited’s iCARE diversity, equity and inclusion program, developed a multi-faceted plan for heirs’ property challenges in their area.

BankUnited identified Liberty City, a low-income African American neighborhood near Miami, as a target area. Recently slated for revitalization, Liberty City is full of new construction projects. “The population is being targeted by developers,” Coronel said. “We want to provide residents with the knowledge and support to make informed decisions.”

To do so, BankUnited has created a consortium of local organizations to work collaboratively in solving heirs’ property challenges in Liberty City. It partnered with First American to access data and title services. It also lined up Legal Services of Greater Miami and Duane Morris Law Firms to provide families with pro bono legal services in the form of mediation and help obtaining clear property titles. Legal interns from Florida International University and Florida A&M University will serve as paralegals and map potential heirs’ properties.

“FHLBank Atlanta really heightened awareness of the challenge and how many billions of dollars are just sitting there that people don’t have access to.”

— Anthony Weekly, Executive Vice President and Chief Community Reinvestment Act and Community Development Officer, Truist Bank

As families decide the future of their properties, Neighborhood Housing Services of South Florida will provide mortgages to people who want to buy out their co-tenants, as well as informational workshops for those who simply want to sell. To spread the word about the services, interns from Florida Memorial University will handle outreach to local churches.

BankUnited invested $90,000 to launch the program and started seeing community clients in January 2023. Yet this is just the beginning of a multiyear commitment to heirs’ property issues and a wide range of support for Liberty City under the umbrella of a new program, Adopt A Neighborhood.

A second target area is Eatonville, one of the first self-governing all-Black municipalities in the United States. BankUnited’s iCARE program made a financial contribution to Legal Services of Mid-Florida to support efforts to resolve heirs’ property challenges in Eatonville.

FHLBank Atlanta’s Continued Leadership

Back at FHLBank Atlanta, the team continues to increase awareness of heirs’ property issues among members and partners, while also investing in practical solutions. In August 2022, the Bank announced a $1 million Heirs’ Property Prevention and Resolution Grant. Each organization that submitted a proposal at the 2021 forum may apply for up to $100,000. The Bank began evaluating applications in October 2022. FHLBank Atlanta has also encouraged developers to reward points for Affordable Housing Program competitive application projects that include heirs’ property solutions.

* The Emergency Land Fund, Inc. (1980). The Impact of Heir Property on Black Rural Land Tenure in the Southeastern Region of the United States.

Banking on Diverse Business Owners

FHLBank Pittsburgh is providing minority- and women-owned small businesses access to capital through a new special-purpose credit program.

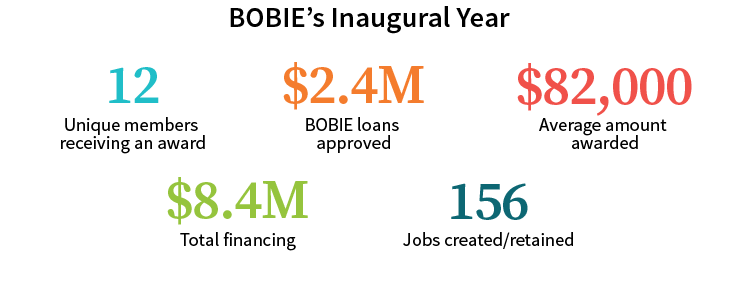

Sometimes traditional lending standards are all that stand between a promising small business and the funding it needs for long-term growth. That gap can be even wider for minority- and women-owned small businesses, with research documenting persistent barriers in their access to capital compared to their white- and men-owned counterparts. To meet the needs of underrepresented small businesses, the Federal Home Loan Bank of Pittsburgh (FHLBank Pittsburgh) established the Banking On Business Inclusion and Equity fund (BOBIE) in 2022 — and awarded $2.4 million in funding during its inaugural year.

BOBIE is a set-aside that builds on the success of Banking On Business (BOB), FHLBank Pittsburgh’s small business loan product. In its 22-year history, BOB has provided $88 million in funding to 952 qualified small businesses that otherwise would not meet members’ traditional underwriting requirements. BOB’s unsecured secondary loans of up to $200,000 per small business are made in conjunction with a member’s first loan. BOBIE, as a special-purpose credit program, offers minority and women small business owners the same benefits as BOB, with enhanced eligibility criteria to increase owners’ access to affordable credit.

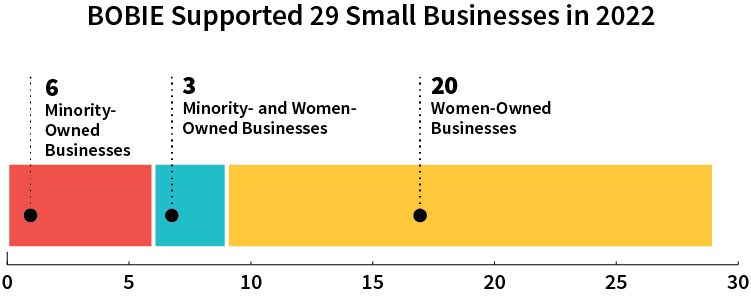

For its June 2022 launch, BOBIE was offered as a $2 million set-aside under the Bank’s $6 million BOB allocation. Once the application period opened, the BOBIE funds were exhausted in only eight weeks. In total, $2.4 million in BOBIE loans were approved for 29 minority- and women-owned small businesses. The average award was $82,000.

“The funding will allow these businesses to flourish,” said John Bendel, Senior Director of Community Investment at FHLBank Pittsburgh. The six minority-owned, 20 women-owned and three minority- and women-owned businesses can put their BOBIE loan funds toward startup, maintenance or expansion costs.

The growth that BOBIE enables looks different for everyone. For a minority- and women-owned freight company in Pennsylvania, it meant the ability to purchase a triaxle truck and fund working capital. For a start-up women-owned coffee shop in West Virginia, it meant the ability to purchase inventory and needed equipment. For the BOBIE recipients collectively, as well as the communities that they call home, BOBIE is expected to help create or retain 156 jobs and leverage $8.4 million in total financing.

“The funding will allow these businesses to flourish.”

— John Bendel, Senior Director of Community Investment, FHLBank Pittsburgh

The high demand and clear economic impact of BOBIE’s debut have underscored the need for the set-aside. FHLBank Pittsburgh has taken note. It plans to continue BOBIE, while also exploring the possibility of increasing funding for both it and BOB in future years. As the Bank strategically closes funding gaps for minority- and women-owned businesses, it’s not only providing capital for small businesses but investing in equity and inclusion.

Suppliers Get Certified for Better Business Opportunities

FHLBank San Francisco invests in diverse suppliers’ growth by sponsoring certification of their business status.

Joy Boese, who founded E3 Consulting Corporation in 2000, has seen a shift in the last several years of business: increasingly more customers request third-party certification that E3 is a woman-owned business. When a client first told Boese in 2015 that she should get her ergonomics and wellness company certified, she lacked the time and resources to tackle the arduous process. She received the same advice from another client years later, but this one — the Federal Home Loan Bank of San Francisco (FHLBank San Francisco) — offered to sponsor her.

In 2019, FHLBank San Francisco began providing Boese and other diverse suppliers with the expert certification services of R Mo Diversity Solutions of Dublin, California. As a certified minority-owned and woman-owned business with 12 years of experience helping others obtain diversity certifications, R Mo typically shaves two months’ time off the normal 90- to 120-day certification process. R Mo guides businesses through completing forms, digging up financial information, navigating strict rules and practicing for interviews.

“We couldn’t have done it without her,” E3’s Boese said of R Mo owner Ranjani Mohana, who is known by many as “The Certification Lady.” Mohana has a team of 20 employees worldwide, helping over 300 companies a year with local, state, federal or international diversity certifications. R Mo said most companies seek certification as minority-, woman-, veteran-, disability- or LGBTQ-owned.

R Mo also provides post-certification support for up to a year, offering individual and group sessions on marketing and business development to help companies leverage their certification for increased business.

“We want to help them expand their businesses and better compete in this highly competitive and ever-evolving marketplace.”

— Sashalla Lemond, Managing Director of FHLBank San Francisco’s Diversity, Equity and Inclusion Office

Sashalla Lemond, Managing Director of the Bank’s Diversity, Equity and Inclusion Office, said such long-term growth is the Bank’s goal for E3 and other diverse suppliers whose certification the Bank has sponsored. “We want to help them expand their businesses and better compete in this highly competitive and ever-evolving marketplace. Diverse certification allows them to be more visible and discoverable to the many private, public and non-profit organizations seeking to expand their supplier diversity efforts.”

For E3, preparation met opportunity and pushed them into new markets during the COVID-19 pandemic. With clients shifting to remote work, E3 pivoted from its traditional onsite client support to “virtual consultation anywhere, in any time zone,” said Boese. Additionally, E3’s certification was completed a few short weeks before a contract opportunity emerged with the same client who recommended the company get certified back in 2015, and just in time for requests from other clients who were developing supplier diversity initiatives.

“Our client base went up almost 40 percent,” Boese said of that period. In addition to its offices in Southern California and Texas, E3 now has staff in nearly every major city. Also, California clients are bringing E3 into international markets by hiring E3 for companywide return-to-work training. The firm has a global staff of 30 and is still hiring in other countries to support its growth.

“Our client base went up almost 40 percent.”

— Joy Boese, President at E3 Consulting Corporation

R Mo continues to experience growth of its own. FHLBank San Francisco is one of 14 corporations that has contracted

R Mo to guide their suppliers through certification. In the past year, R Mo has helped clients Meta and Google make it into the prestigious Billion Dollar Roundtable, which recognizes and celebrates corporations that have spent at least

$1 billion a year with diversified suppliers.

R Mo’s services typically range from $1,500 to $1,800 per local, state and national certifications. The separate application fee adds another $350 to $1,200, depending on the client’s gross revenue. FHLBank San Francisco has footed the bill for about 35 suppliers to use R Mo to determine if they qualify for certification and then walk them through the process.

Boese is grateful to FHLBank San Francisco for making such an investment in E3. “It has paid for itself 10 times over,” she said.

Partnerships Help Diverse Dealers Find Success

FHLBank Boston helps diverse dealers strategize success in new development sessions.

The Federal Home Loan Bank of Boston (FHLBank Boston) expanded its support of diverse dealers in 2022, holding face-to-face development sessions with minority-, woman- and veteran-owned businesses to offer ideas for how they can maximize their partnerships with the Bank.

The Bank has been conducting diverse dealer outreach and support for nearly a decade. According to George Maroun, Treasurer at FHLBank Boston, the in-person development sessions were added to give more structure than past touchpoints. The Bank meets beforehand and analyzes the dealer’s past activities and then brings recommendations to the meeting on how the dealer can increase business with the Bank. “We emphasize the areas of the business and the markets where we need them to be focused in order to find and sustain success in a competitive field,” Maroun said. The meetings also offer dealers the opportunity to ask questions or describe their business priorities and plans.

Capital Markets is a complicated business for the Federal Home Loan Bank System, one that also contains a substantial amount of risk. To help manage the Capital Markets business as well as minimize risks, the Federal Home Loan Banks and FHLBanks Office of Finance partner with finance firms (known as dealers) that facilitate these financial transactions for the System. Given that transactions regularly involve millions and, at times, billions of dollars, the dealers must be well capitalized to support the transaction sizes and volumes. This can create a challenge for smaller, diverse-owned firms, which typically are not as well capitalized and/or specialize in certain types of transactions, limiting their ability to regularly be used by the System. Part of the FHLBank System’s mission is to support these diverse dealers by giving them opportunities to expand their work with the Banks.

The Bank advises dealers on how to increase business opportunities and explains why having a larger distribution network to buy and sell bonds can create a competitive advantage for them. Maroun said building a global distribution network is something that takes a lot of capital, time and resources; the Bank expects it to be a journey for smaller dealers. FHLBank Boston is committed to being there along the way.

The Bank met with a quarter of its diverse dealers in 2022. One of them was Bancroft Capital, the only service-disabled veteran-owned broker-dealer in Pennsylvania. Bancroft works with other banks in the Federal Home Loan Bank System and was pleased when FHLBank Boston reached out to schedule a development session. According to Ray Hally, Bancroft’s Director of Equity, FHLBank Boston “laid out a plan. They articulated, in a very clear, concise way, where we can try to find ways to work together.”

Founded in 2017, Bancroft is based in Fort Washington, north of Philadelphia. They have 29 employees, 11 of whom are veterans. In 2019, Bancroft launched a Veteran Training Program to help disabled veterans, first responders and their spouses build a second career in finance. According to Hally, the veteran program sets Bancroft apart from other diverse dealers. He said FHLBank Boston’s proactive approach with Bancroft shows the Bank’s support of diverse dealers and dealers that have a stake in a family-oriented mission that uplifts an underrepresented sector of the community.

“We emphasize the areas of the business and the markets where we need them to be focused in order to find and sustain success in a competitive field.”

— George Maroun, Treasurer at FHLBank Boston

At the end of their conversation, Maroun encouraged Bancroft to continue the dialogue and partnership for the long term. “And that’s what’s noble about that process,” Hally reflected. “It’s people looking to work with people. It’s a people business. That conversation gave us what we should be looking to do to help them and what they can do to help us. That’s what a true partnership looks like.”