Creating Windows of Opportunity

Equal access does not guarantee equal opportunity. Since not everyone has the same starting point, the Federal Home Loan Bank System institutes equity and inclusion practices that create windows of opportunity for women, minorities and people with disabilities. Read the Stories

Smart Moves

When FHLBank Chicago built out a new office space in Chicago’s historic Old Post Office building, they set a stretch goal for the number of diverse suppliers — and crushed it.

You get few chances to make a significant impact in sharing vendor opportunities, and the Federal Home Loan Bank of Chicago (FHLBank Chicago) was determined to do it right. FHLBank Chicago was building out 135,000 square feet of new office space in the 100-year-old historic Old Post Office building in Chicago and set an ambitious goal to spend greater than 50 percent of the project budget on diverse suppliers.

“Typically, on projects with large subcontract requirements, you can get there with one vendor and call it a day. Federal Home Loan Bank of Chicago was really into the diversity within the diversity.”

— Jason Watland, Executive Construction Incorporated Vice President

“A full build-out of this size, with this investment, happens quite infrequently, maybe once every 25 to 30 years. We quickly realized that we had the ability to influence where that spend went,” said Monica Doyle, Vice President, Director, Strategic Sourcing and Accounting at FHLBank Chicago.

The goal was aggressive and higher than diverse vendor contracting targets for Illinois and Chicago, which generally range from 20 to 30 percent. “We said if we’re doing this, let’s do it. We are going to do better than what we’ve seen locally for a very large project,” Doyle said.

Meeting the goal would have been monumental, but FHLBank Chicago went well beyond its target — it shattered the goal with 81 percent of spend going to diverse suppliers.

Diversity within the Diversity

It took a committed team to reach such a significant goal. FHLBank Chicago worked closely with Executive Construction Incorporated (ECI), the general contractor on the project, to track the spend to diverse vendors. Because ECI managed a large portion of the work, their contracting plan would impact the Bank’s goals. This project was different from others the company had worked on, said Jason Watland, ECI Vice President, because FHLBank Chicago wanted to ensure all diversity groups were well represented.

“Typically, on projects with large subcontract requirements, you can get there with one vendor and call it a day. Federal Home Loan Bank of Chicago was really into the diversity within the diversity,” Watland said.

FHLBank Chicago set aspirational goals for women-, veteran- and minority-owned vendors to expand the range of businesses that were involved. ECI brought strong relationships with diverse vendors. Even so, the stretch goals forced ECI to reach outside their existing networks to meet more diverse contractors. In the end, the project used 20 different diverse contractors with a total spend of over $24 million.

One of those contractors was Slate Demolition, a woman-owned demolition company in Chicago that had worked with ECI before. This project, while not the biggest Slate had done, was special because of the historic site, said Kathy Dziedzic, managing director at Slate. It was also a great portfolio piece. The building restoration has gotten a lot of national attention and has won awards; being able to say you were part of the project is a big deal for contractors.

Dziedzic said the project was important because it set a precedent. “It shows it can be done,” she said. With low contracting goals, one woman-owned vendor gets an opportunity over another woman-owned vendor. With a high contracting requirement, you have to go out to several woman-owned vendors, Dziedzic said.

For ECI, the project represented its highest net spend on diverse vendors and changed the way they think about diverse spend.

Watland said, “When new clients come to us and want to know if we can hit their 30 percent diverse subcontract spend, we say ‘not a problem. You know, let’s go beyond that. Let’s exceed everyone’s expectation.’”

Jason Watland of ECI and Kathy Dziedzic of Slate Demolition talk about working on the Chicago project.

Promoting Diversity

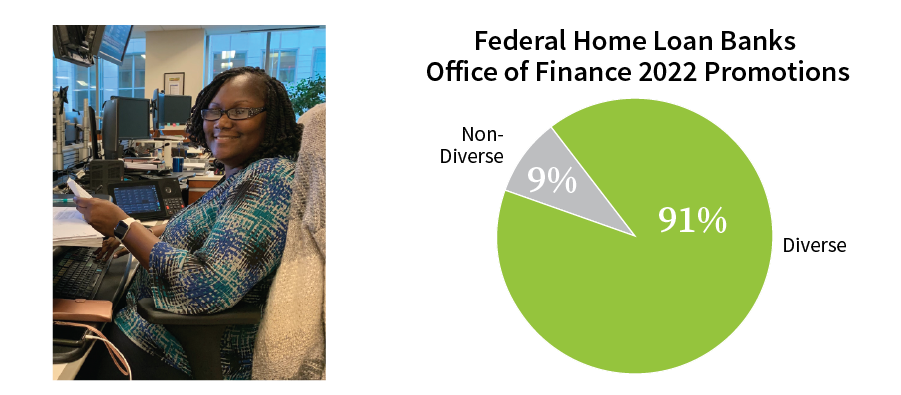

91% of recent promotions at the FHLBanks Office of Finance went to diverse candidates.

Sandra Tetteh’s drive and willingness to learn took her from an entry-level position at the Federal Home Loan Banks Office of Finance (FHLBanks Office of Finance) to running the short-term funding desk for the Office of Finance, which is the United States’ second-largest issuer of debt. During her two and a half decades at the office, Tetteh has earned her bachelor’s and master’s degrees, had three kids and earned promotions approximately every three years.

Her trajectory is not the norm in the finance industry. Women and especially Black women, like Tetteh, are a minority in senior management positions across the finance industry, according to a 2021 McKinsey study. The Office of Finance, like the FHLBank System at large, is trying to change that by prioritizing diversity, equity and inclusion in the way it hires, retains and advances staff. In 2022, when Sandra was promoted to Senior Manager, 91 percent of promotions in the Office of Finance went to diverse candidates.

“We hire and promote the most talented and most qualified people,” said Leigh Flajnik, Senior Manager at the FHLBanks Office of Finance, “and we cast a very wide net to ensure our applicant pool is diverse.” Increasing diversity in the workforce helps increase the diverse promotion slates. That’s an important step in closing the gap in minorities and women who are in senior management and executive positions.

“We hire and promote the most talented and most qualified people, and we cast a very wide net to ensure our applicant pool is diverse.”

— Leigh Flajnik, Senior Manager at the FHLBanks Office of Finance

The FHLBanks Office of Finance works with organizations focused on attracting diverse talent, such as the Hispanic/Latino Professionals Association, and uses tools like DCJobs.com, an employment and diversity website that matches employers with diverse candidates. Currently, 72 percent of the FHLBanks Office of Finance staff is diverse. The Office also tracks the diversity of its workforce and commits to promoting from within when possible.

“We develop our talent, give them more responsibility and opportunities for promotion when we can,” said Flajnik. That matched well with Tetteh’s drive for the next opportunity. Flajnik said Tetteh is one of their biggest success stories. “Managing our entire short-term funding desk is a big job. She’s a big deal.”

“I’m always trying to prepare myself for the next level,” Tetteh said. “Taking on more things, participating in more meetings, continuing with my education.”

“I’m always trying to prepare myself for the next level. Taking on more things, participating in more meetings, continuing with my education.”

— Sandra Tetteh, Senior Manager, Short Term Funding Officer, FHLBanks Office of Finance

“It has been a joy to watch Sandra grow at the FHLBanks Office of Finance. As she progressed through various roles and increasing responsibilities in Capital Markets over the past 24 years, Sandra’s ‘can do’ attitude, knowledge and experience have been instrumental in our mission to provide low-cost funding and market access to the FHLBanks,” said Ed Bridge, Director of Funding.

Tetteh found herself among advocates in the FHLBanks Office of Finance, working with people who would answer questions and allow her to shadow them. She’s returning the favor, sharing advice with younger people at the Office, hoping to pave the way for the next generation.

Mentorships Help Employees Visualize Success

FHLBank San Francisco’s mentorship and rotation programs are attracting diverse staff, helping to level the playing field when it comes to leadership readiness.

Demontre Buckson believes ‘If you can envision yourself there, you can be there.’ The professional development programs at the Federal Home Loan Bank of San Francisco (FHLBank San Francisco) are helping Buckson see himself in countless new places.

After graduating from Howard University with a degree in Business Administration, Buckson, a lifelong East Coaster, was eager to explore … the country, the finance industry and the future. He started a virtual internship for FHLBank San Francisco in June 2021 and jumped at the chance to move to San Francisco in February 2022 to become the first employee in the Bank’s pilot rotational program.

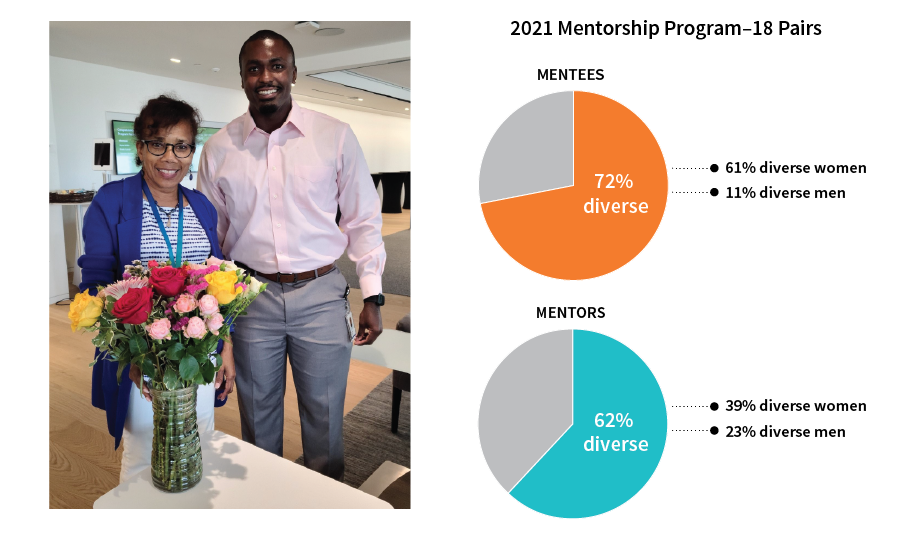

The program places him for six months in different departments to become acquainted with multiple critical Bank functions — community investment, internal audit department and capital markets. He also joined the Bank’s mentorship program which matches less experienced professionals with more senior staff at the Bank. He and his mentor were one of 18 mentor/mentee pairs in the 2021/22 program.

“I’m always eager to learn more, and I knew these programs would lead me to be more competent in my day-to-day job and eventually improve my knowledge of the financial services industry,” Buckson said.

FHLBank San Francisco offers internal and external professional development programs across the lifecycle of a person’s career. Maxine Moir, the Bank’s Chief Human Resources Officer, said diversity, equity and inclusion is an important focus of those development efforts. An external collaboration with McKinsey Academy offers management accelerator programs for African American, Hispanic and Asian employees and diversity and inclusion training is available to all staff through eCornell. Homegrown programs like the mentorship and rotation programs are attracting diverse staff, helping to level the playing field when it comes to leadership readiness, according to Moir. FHLBank San Francisco is creating a tool to provide an overview of development options in a more user-friendly way.

“I’m always eager to learn more, and I knew these programs would lead me to be more competent in my day-to-day job and eventually improve my knowledge of the financial services industry.”

— Demontre Buckson, Rotational Program Associate, FHLBank San Francisco

For Buckson, the benefits from the development programs are both personal and professional. He and his mentor, Diane Jester, a 25-year employee of the Bank, met virtually once a week throughout the program. Now that their program is over, they continue to meet, virtually and in person, as friends and colleagues.

“We have a lot in common,” Buckson said. “We’re both African American, we’re both career-oriented and want success and we’re both intellectually driven.” Those similarities help him picture having a long, successful career at FHLBank same as Jester.

The ways in which they’re different might be even more important.

Jester is Managing Director of Credit and Collateral Risk Management. She worked at FDIC before joining FHLBank San Francisco and has a wealth of knowledge in every area of finance. Her willingness to teach Buckson about the FHLBank System and the financial services industry has been invaluable. She talks to him about how to achieve success, collaborate with people and instill trust in team members. She also helps him think strategically about his goals and aspirations, which Buckson said is the C suite. When he gets there, he said, he will give back by mentoring others.

From The Congo to Finance Career via FHLB Des Moines

FHLB Des Moines’ internship program with majority-minority public schools in Des Moines pave way for minority students.

Lwembo Mwenyi chose an internship at the Federal Home Loan Bank of Des Moines (FHLB Des Moines) over a job at the grocery store when he was a high school senior, thinking he would make money and learn about credit cards. Five years later he’s earned his degree in finance and management information systems, completed an internship on Wall Street working for Fitch Ratings and is embarking on a career at IBM as a consultant.

That first day at FHLB Des Moines, Mwenyi wondered where the customers and tellers were. The 19-year-old had come from the Congo to the United States just a few years before, and he was learning as much as he could about his new country, including the language. His life as an orphan and a refugee hadn’t been easy, but he was now settled with his aunt and four siblings and wanted to understand the financial systems so he could help the people he cared about.

A career in finance was the furthest thing from his mind.

“I just wanted to save a little bit of money and prepare for college,” said Mwenyi. “After working in a financial institution, I thought ‘okay, why not, I could do that.’”

Seeing what’s possible is important for young adults. The FHLB Des Moines high school internship program, which began in 2017, works with students from two Des Moines public schools — majority-minority North High School, Mwenyi’s alma mater, and majority-minority East High School — through YouthWorks, an Iowa work-based learning program. The internships give students exposure to working in finance, providing exposure and plenty of resume-building professional experience. For the Bank, it’s a way to build and nurture the next generation of talent while championing diversity in the financial services industry.

“I just wanted to save a little bit of money and prepare for college. After working in a financial institution, I thought ‘okay, why not, I could do that.’”

— Lwembo Mwenyi, former intern at FHLB Des Moines

Despite recent increases in women and racial minorities in finance, the industry is still predominantly composed of white men. While the entire finance system recognizes the value of a diverse workforce, the Federal Home Loan Bank System is particularly focused on increasing its diversity. Programs like the high school internship in Des Moines are part of that effort.

After a pause during the pandemic, the program resumed with two students in the 2022 cohort. Mwenyi is the clearest example of why the program is valuable and how it can work.

After his first internship, Mwenyi returned to FHLB Des Moines during summers, holiday breaks and for a six-month co-op his junior year in college. His interest in finance kept growing, in part because he had developed many relationships and felt welcome at FHLB Des Moines, he said.

Why Mentorships Matter

Mwenyi developed a close mentor relationship with then-CEO of the Bank, Mike Wilson. Wilson’s approachability and leadership created an environment where everyone felt welcome, according to Mwenyi. Having regular conversations with the CEO boosted his confidence. For Mwenyi, “Mike Wilson is the definition of leadership. If the CEO is speaking with you, then obviously, you can have confidence speaking to really anyone.” Wilson, who retired from the Bank in 2020, continues to mentor Mwenyi. When Mwenyi interned at Fitch Ratings on Wall Street, Wilson visited him in New York. And when Mwenyi was interviewing for jobs, Wilson helped him prepare and guided him as he prepared to accept his first full-time position.

“The Bank has shown me that I can become whatever I want to be. They created a way for me. I don’t think I would have gone to New York without the Bank experience on my resume. I don’t think my position at IBM would be possible without the Bank. I hope I can give back to them in the future.”

— Lwembo Mwenyi, former intern at FHLB Des Moines

“I really needed guidance and Mike gave me that. He is like a father figure to me. He understood me and what I am good at,” Mwenyi said. “I hope that other kids have the opportunity and exposure to leaders like Mike. It is truly a blessing.”

Mwenyi had planned to start his career at FHLB Des Moines, but life is taking him to Washington, D.C, he said. The job at IBM combines his skills in both of his majors — information systems and finance. Someday, he hopes to bring his experiences in D.C. back home to Des Moines and maybe to FHLB Des Moines.

“The Bank has shown me that I can become whatever I want to be,” he said. “They created a way for me. I don’t think I would have gone to New York without the Bank experience on my resume. I don’t think my position at IBM would be possible without the Bank. I hope I can give back to them in the future.”

Lwembo’s Legacy

In 2019, the Bank launched a scholarship program for aspiring first-generation college students from North High School interested in degrees in Business, Finance, Accounting, Human Resources or Information Technology.

Applicants are evaluated on their high school academic performance, their community service activities and an essay. After a hiatus during the pandemic, the program restarted, and the Bank awarded two first-generation college students with $4,000 in scholarships for tuition and books.

Diverse Dealer Gets a Shot at the Lead

FHLBanks Office of Finance led the restructuring of how the System selects lead dealers for large financial transactions, opening the door for diverse dealers.

The Federal Home Loan Bank System changed its selection process in 2021 to give diverse dealers the opportunity to lead a Syndicated Global transaction for the first time. Soon after, Loop Capital Markets, an African American-owned investment bank, brokerage and advisory firm, led a $1 billion Syndicated Global transaction along with BofA Securities and Wells Fargo Securities.

Capital Markets is a complicated business for the FHLBank System, one that contains a substantial amount of risk. To help manage the Capital Markets business and minimize risks, the Federal Home Loan Banks (FHL Banks) and FHLBanks Office of Finance partner with finance firms (known as dealers) that facilitate financial transactions for the System. The transactions regularly involve millions and, at times, billions of dollars, so dealers must be well capitalized to support the transaction sizes and volumes. This can create a challenge for smaller, diverse-owned firms, which typically are not as well capitalized and/or specialize in certain types of transactions, limiting the System’s ability to regularly work with them. It is part of the System’s mission to support these diverse dealers by giving them opportunities to expand their work with the Banks.

FHLBanks’ selection process historically favored larger dealers that used their balance sheets to support FHLBanks across all programs. The FHLBanks Office of Finance worked with the FHLBanks to restructure the process, opening the door to diverse dealers that weren’t big enough to participate in every program but had proven they had strong execution, relationships and distribution capabilities. Being selected to lead a Syndicated Global transaction gives dealers access to more bonds to sell, and they get higher concessions that translate into higher profits, said Ed Bridge, Director of Funding at the FHLBanks Office of Finance. And as leads, the dealers engage with more investors, which increases opportunities to develop relationships and create expanded business opportunities.

“It’s certainly a feather in our cap and a marketing tool that we can utilize to continue our growth across other products.”

— Chris Denker, Senior Vice President of Fixed Income Agency Trading, Loop Capital Markets

Loop Capital is among the largest privately held investment banks in the country. Founded in 1997 by Jim Reynolds, the firm started as a team of six professionals; today it has almost 300 employees. Loop Capital has developed into a global financial services provider, and the partnership with the FHLBank System has prepared the firm for expanded opportunities with other issuers and more investors. In 2020, Loop Capital was mandated as a Lead-Left Bookrunning Manager in a $1.2 billion investment-grade corporate bond transaction for Allstate Corporation. This opportunity allowed Loop Capital to showcase its competencies of successfully underwriting, pricing and billing/delivering a benchmark transaction for a Fortune 100 company. Several other successful issuer mandates provided a foundation and opportunity for Loop Capital to co-lead FHLBanks Syndicated Global transaction in 2021. Working with the co-leads, the firm continued to illustrate and signal to the market that the firm is fully capable of participating in Syndicated Global transactions as a Lead Manager.

“The feedback from the other leads and FHLBanks was that everything went smoothly,” said Chris Denker, Loop Capital’s Senior Vice President of Fixed Income Agency Trading. “It’s certainly a feather in our cap and a marketing tool that we can utilize to continue our growth across other products.”

Over 25 years, the firm has continued to expand its business lines, having started as a public finance and municipal sales and trading firm, to include banking government sponsored enterprises (GSEs) like FHLBanks, Fannie Mae and Freddie Mac, and taxable fixed income investors. Additional expansion areas include covering Sovereigns, Supranational and agencies such as the World Bank. The firm’s experience leading the FHLBanks Syndicated Global transaction positions Loop Capital to partner and add value to other GSE issuers like the Farm Credit System, according to Denker.

Loop Capital continues to reinvest in growth. Its equity capital position increased by 466 percent between 2019 and 2021.

Loop Capital’s lead dealer status was recognition of the company’s growth, said Bridge, and he hopes to see more diverse dealers grow in the same way. The FHLBanks Office of Finance’s Investor Relations Team engages regularly with diverse dealers to educate them about the FHLBank System and the products it offers to help diverse dealers expand their businesses.

According to Denker, the FHLBank System and other GSEs like it really go above and beyond when it comes to working with diverse firms. He hopes that someday, having a diverse dealer lead a Syndicated Global transaction isn’t a story at all, but just business as usual.

Capital Markets