Laying the Foundation

When the Federal Home Loan Bank System committed to advancing diversity, equity and inclusion (DEI), it began laying a solid foundation for structural change. Intentionally incorporating DEI into its leadership and human resources practices, the FHLBanks are better positioned to meet the needs of the diverse communities they serve. Read the Stories

Diversity: On and Beyond the Board

Intentional, systematic drive to expand board diversity across the System is working.

A drive for diversity needs to be intentional and systematic for it to be successful. Recognizing this, the Federal Home Loan Bank System (FHLBank System) created a subcommittee to focus on systemwide efforts to increase board diversity. The Chair/Vice Chair Subcommittee on Board Diversity, established in 2019, created a reference guide with ideas and best practices for increasing board diversity.

Larry Thompson, Vice Chair of the Federal Home Loan Bank of New York’s board, was the first chair of the board diversity subcommittee. Under his leadership, the subcommittee created a guide that suggests ways to increase diversity and create a diverse pipeline for future board members. More importantly, the guide sends a clear message that board diversity is a priority for the FHLBank System.

Based on 2021 board numbers, the System’s commitment to diversity is driving progress. Between 2020 and 2021, nine out of 12 FHLBank entities increased diversity on their boards, adding women as well as men and women of color. In another emerging trend, the number of diverse candidates for independent board positions increased at several Banks, giving them more diverse candidates to choose from.

The guide has been instrumental in this progress. FHLBank System boards are made up of member directors — officers and directors of member institutions who are nominated for placement on the ballot and elected by the members — and independent directors — who bring experience and expertise from areas outside of banking, and who are identified through an application process, nominated for placement on the ballot by current FHLBank board members and elected by members. While boards have greater influence on the process of independent director selection, Thompson and the subcommittee also focused on how boards can impact the process of developing a diverse candidate pool for member directors. The guide recommends educating member institutions about the importance of diversity and looking for opportunities to mentor diverse candidates as they are promoted to leadership roles in member institutions. The guide also clarifies that member directors don’t have to be CEOs of their institutions; they can serve other leadership roles, which expands the pool of candidates.

“We’re proud of the document we came up with, and it’s been successful,” Thompson said. “Each board that has seen an increase in diversity has been very happy.”

Why Diversity Matters

The goal is to have boards that reflect the people they serve. This means different races, ethnicities and genders but also different experiences and demographics. As Annie Lazarus, a member of the Federal Home Loan Bank of Boston board, said, “A person from rural Maine is very different from a person who grew up in Boston. What’s beautiful is that we recognize diversity in all its forms.” The boards also need members with diverse expertise, for example, experts in cybersecurity or information technology.

It can feel like a puzzle, aligning gaps in skillsets with gaps in gender or racial representation with gaps in demographic representation across the Bank’s region. It’s not easy, but those Banks that have expanded board diversity have seen a positive difference.

“Everybody brings different perspectives based on their background, and the more diversity we have — gender, ethnicity, race, life experiences, expertise — the better we are,” said Ellen Lamale, chair of the Federal Home Loan Bank of Des Moines board. Lamale joined the board in 2012 as one of only three women. Today, the 22-person board has eight women, four of whom are Asian, Hispanic and Native American.

Since 2020, FHLBank New York’s members have elected three women independent directors to its board — including a Black woman who resides part-time in the U.S. Virgin Islands and a Hispanic woman from Puerto Rico. A Hispanic woman and Hispanic man from Puerto Rico were already serving on the board. According to Thompson, the Bank’s board representation from Puerto Rico and the U.S. Virgin Islands, territories in the FHLBank New York district, has never been stronger.

“Everybody brings different perspectives based on their background, and the more diversity we have — gender, ethnicity, race, life experiences, expertise — the better we are.”

— Ellen Lamale, chair of the FHLB Des Moines board

The Federal Home Loan Bank of San Francisco’s majority-diverse board has twice been recognized by the National Association of Corporate Directors (NACD) for leveraging the power of diversity, equity and inclusion to enhance governance and create long-term value for their organizations and stakeholders. The Bank was among three winners of the annual NACD DE&I Award™ in 2021 and among 20 finalists for the award in 2022.

Beyond the Board

Louise Herrle, vice chair of the Federal Home Loan Bank of Pittsburgh board, worked closely with Thompson to produce the first reference guide and is now chair of the subcommittee. She is proud of the things they’re doing and wants to take the next step. She envisions the System producing thought leaders on the issue of meaningful data gathering for diversity, equity and inclusion. In Pittsburgh, they’re tracking diversity on the board and the diversity of board chairs and vice chairs and board committee chairs.

Many around the System are leaning forward, including increasing involvement in the independent director selection process. For example, this year every member of the Boston governance committee interviewed all candidates for independent director rather than having a few people screen the first round of interviews. According to Lazarus, it was a way to minimize unconscious bias.

“This goes way beyond checking the box,” Herrle said. “Across the System, the Banks are constantly thinking and brainstorming new strategies. There is true, true desire to make a difference.”

Inclusive Human Resources

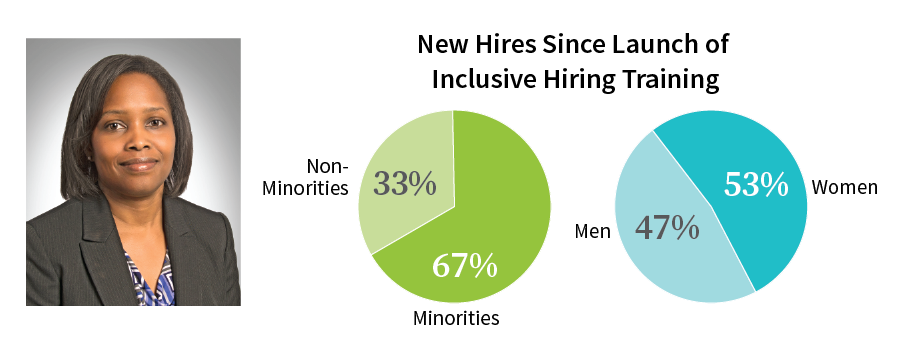

FHLBank Atlanta builds inclusion into hiring and succession planning.

As Federal Home Loan Bank System employees develop and implement initiatives promoting diversity, equity and inclusion in the communities they serve externally, the System’s human resources offices are working to ensure the workforce sees that same commitment internally. Since 2020, the Federal Home Loan Bank of Atlanta (FHLBank Atlanta) has been prioritizing its people through inclusive hiring practices and diverse succession planning.

Consistency Over Connection

As the Associate Director for Community Investment Services at FHLBank Atlanta, Tomeka Strickland manages a team of 19 associates and has been with the Bank for over 20 years. Even with her years of experience interviewing and hiring employees, she has been pleasantly surprised by the inclusive interview training that the Bank released in fall 2021.

“It is important to approach every interview with an unbiased perspective,” Strickland said. Yet the training offered by the Bank helped her recognize some subtle examples of bias that should be taken into consideration. Shared experiences like graduating from the same college, belonging to the same sorority or even wearing a similar hairstyle all make people feel connected to one candidate — which may be unfair to the next. “People may not realize it, but on paper, that’s bias,” said Strickland.

After completing the brief, self-paced online learning module, Strickland approaches all interviews with a focus on consistency to ensure candidate connection does not creep into the process. The training and accompanying hiring guide helped her develop consistent questions with a simple rating scale and structure a diverse interview panel. The result was the selection of a candidate that she believed to be the most qualified but who was noticeably different from her.

Strickland said she encourages the employees she manages to take the training as well. “This is the Bank speaking with one voice. If all hiring managers have a consistent way of interviewing, that makes the candidates feel they have an equal opportunity to get a job here.”

From Job Posting to Offer

Dawn Gehring, Senior Vice President and Chief Human Resources Officer, said the interview training “is just one of a number of steps the Bank has taken in recent years to create a more inclusive and equitable hiring process.”

To start, for a wider, more diverse applicant pool, the Bank took a closer look at its job postings. It scrutinized the minimum qualifications and narrowed them down to those most essential to the job.

The Bank also reconsidered the information it collected from applicants. “We stopped asking for previous salary,” said Gehring. “Historically, women and minorities have earned less, so if you ask for previous salary and base a job offer off of that, you are perpetuating that cycle.” Instead, the Bank asks candidates their salary expectations before extending job offers based on the role, market analysis, years of experience and skill sets.

Atlanta’s Comprehensive Approach to Inclusive Hiring

- Revise job postings

- Eliminate salary history from applicant data

- Train hiring managers

- Aim for a minimum of 1 diverse candidate in final interview stage

FHLBank Atlanta’s final hiring change was to track the diversity of candidates in the final interview stage, with the goal of having at least one diverse candidate. At the end of the second quarter of 2022, the Bank had a 97 percent success rate.

Diversity in Succession Planning

Like most organizations, FHLBank Atlanta has a long history of succession planning for its executive roles. However, in more recent years it has expanded that planning to factor in diversity and drill down to the management level.

For its management succession plan, the Bank has identified 50 to 55 roles as critical to its operations or so unique to the Bank that such experience is not easily found on the job market. Gehring said the Bank is focused on diversity at this level, recognizing it as a pipeline of succession talent for the Bank’s executive roles.

“We closely watch and monitor our diversity statistics within our succession planning, capturing those statistics in the plan itself,” Gehring said. Of the positions in the Bank’s succession plan, 76 percent have female and minority employees identified as potential successors. “We’re identifying them by individual on the plan. It’s visible, it’s monitored, it’s discussed.”

Such transparency and intentionality, along with FHLBank Atlanta’s comprehensive plan to build DEI into every phase of the human resources process, are fostering an internal culture that reflects the diversity of the communities that employees serve.

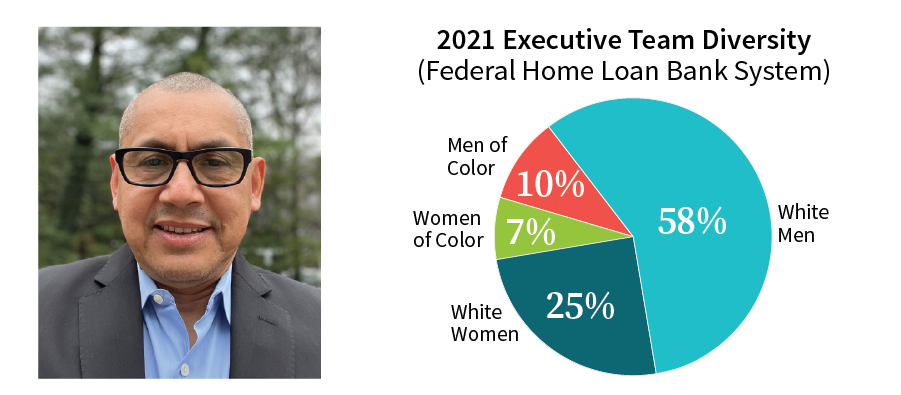

Distributed Leadership Builds Diverse Pipeline

FHLBank New York systematically offers leadership opportunities to non-managerial employees to build skill sets, confidence and a diverse pipeline to the C suite.

There’s a lack of diversity at the highest levels of most financial institutions, according to a recent McKinsey study. The number of women and men of racial minorities hired in the financial sector has increased, but their representation decreases in management and C-suite positions. Federal Home Loan Bank of New York (FHLBank New York) is testing new distributed leadership strategies to combat this fall off, hoping to develop a pipeline of strong, diverse leaders for the future.

The concept of distributed leadership is to involve as many direct reports as possible in committees, cross-functional teams and systemwide efforts. Being included in decision-making processes gives employees opportunities to practice problem-solving, decision-making and presenting, allowing them to build the skill sets and confidence needed to become effective leaders. In this way, growth and inclusion are built into the company culture.

FHLBank New York developed a leadership framework, a list of attitudes and aptitudes its leaders should possess. FHLBank New York’s Culture Management Office then asked managers to identify opportunities for their staff to gain experience in these areas. According to Christina Levatino, Senior IT Audit Manager at FHLBank New York and a member of the Culture Management Office, they asked managers to think about a decision they could delegate to someone else, or an important presentation a staff member could make in their place. “We asked them to give the baton to someone else,” she said.

This wasn’t a suggestion. Identifying distributed leadership opportunities became part of managers’ incentive compensation plans. This keeps the Bank accountable for developing leaders strategically and consistently across the Bank and culture, according to Levatino.

“It reaffirmed that I have the ability to sit in front of an audience and make a presentation. Especially for somebody like me whose English is a second language, it’s a little bit more challenging than the average person. But you know, just be confident of what you know, and go for it.”

— Jorge Nieves, Data Architect at FHLBank New York

During the pilot in 2022, FHLBank New York managers proposed close to 140 distributed leadership opportunities. Each opportunity was entered into the Bank’s ServiceNOW system. Once reviewed and approved by members of the Culture Management Office, managers will schedule the opportunities.

Data architect Jorge Nieves was asked to update the Board of Directors on a new approach toward internal audit measures. He prepared a presentation and spoke to the board about the structure of the platform used to perform data analytics, the kind of data analysis being done and the methods the team was using to make work more accurate and efficient.

The feedback was immediate and positive. The board was thrilled with the firsthand demonstration of the expertise and innovation on display at their Bank. Members were able to ask questions of subject matter experts, rather than managers, and the internal audit team got to show they were making good use of the Bank’s investment in technologies and employees. Nieves gave leadership clear, thorough answers about his day-to-day work.

“It reaffirmed that I have the ability to sit in front of an audience and make a presentation,” said Nieves, who is in his eighth year with the Bank. “Especially for somebody like me whose English is a second language, it’s a little bit more challenging than the average person. But you know, just be confident of what you know, and go for it.”

Once the pilot program is fully established, the goal is for employees to identify areas for distributed leadership opportunities. The end goal is to get everyone to rethink who is given the opportunity to make decisions and influence outcomes. With distributed leadership strategies in place, the answer is simple: everyone.

FHLBanks Promote Diversity in Legal Field

Through mentoring, lawyers at the FHLBank New York and other Federal Home Loan Bank entities give law students confidence and encouragement.

The Federal Home Loan Bank System (FHLBank System) joined the Leadership Council on Legal Diversity (LCLD) in 2017 to help increase diversity in the legal profession. All 11 Federal Home Loan Banks and the FHLBanks Office of Finance currently participate in the LCLD membership and have been consistently recognized as LCLD top performers (most recently in 2022), meaning they are in the top 20 percent of members based on participation in LCLD programs and activities.

The LCLD membership is just one example of the System’s commitment to diversity, equity and inclusion. According to the LCLD website, diversity in the legal field is at 15 percent compared to 27 percent in architecture and engineering, 29 percent in accounting and 33 percent for surgeons and physicians. LCLD’s four programs are designed to provide high-potential diverse attorneys and law school students with support at different points in their career at which they might need the most help: Pathfinders (for early-career attorneys), Fellows (for mid-career attorneys), 1L Scholars (which involves recruiting law students for summer-long internships at partnering institutions) and Mentorship (which pairs LCLD member organization attorneys with first-year law students for a yearlong partnership). By participating, the FHLBank System is helping to build a more diverse pipeline of candidates for legal positions in the field and in the System.

Over the course of its membership, the System has nominated employees to participate in all four LCLD programs. Paul Friend, who serves as a General Counsel for the Federal Home Loan Bank of New York, has mentored four first-year law students and is now mentoring his fifth. He initially considered not volunteering, because he feared he didn’t have anything of value to offer. He also worried about finding common ground with students whose generational experiences and cultural backgrounds felt far removed from his own. But after four mentoring experiences, Friend believes he has benefitted as much as his mentees. “It turned out that we had more in common than I would have thought, and that was healthy and helpful for me,” Friend said. “I would like to think that my giving them lessons has and will help them in their careers. I have enjoyed the sharing of knowledge across generations and across cultural experiences. These are people whom I would not have met otherwise. I think it was great for them and, perhaps, it may have been even better for me.”

“When you come from a minority background and you don’t have someone in your family who has gone to law school, you have those feelings of self-doubt.”

— Alisher Alimov, Brooklyn Law School student

The mentorships are intended to last one year, but Friend maintains contact with his former mentees. One of them is Alisher Alimov, a Brooklyn Law School student who was starting law school in 2020 when he was partnered with Friend. Alimov is a first-generation high school and college graduate who, at age 14, emigrated from Tajikistan to Queens. Law school is difficult for everyone, but Alimov anticipated extra challenges. “When you come from a minority background and you don’t have someone in your family who has gone to law school, you have those feelings of self-doubt,” Alimov explained. “Like, ‘Will I be able to do this? Is this for me? How am I going to finish this?’”

Friend’s support proved a crucial motivator for Alimov. “Paul’s constant reassurance that you’re here for a reason, that you’ve made it this far and you’ve been accepted based on merit … having that said to you over and over again helps you believe it,” he said.

Friend stayed in contact with Alimov after the formal mentorship was over, helping guide him in his career path. Alimov was interested in immigration law, and Friend encouraged him to intern with a firm that specialized in that area. Alimov interned in immigration law with the Legal Aid Society but found it too emotionally taxing, considering his own immigrant background and experience. Now, he is planning to work in mergers and acquisitions.

Friend said seeing his support and guidance inspire students to keep going is the most rewarding aspect. He found that his own experiences in law school were not that different from students’ experiences today. He tells his mentees, “You wouldn’t have gotten into law school unless you were smart and talented. And people usually don’t fail overnight. So yeah, you can worry about grades and teachers and stuff. But you’re going to succeed.”

In turn, Alimov extends that support to his peers. “I try to reassure people that you made it here. Everything that you’ve been doing has led you to this point, so just keep on doing what you’re doing and you’re going to be fine.”