On Oct. 26, 2022, the Council of Federal Home Loan Banks submitted a comment letter to FHFA Director Thompson in response to the Federal Housing Finance Agency’s (FHFA) review of the Federal Home Loan Banks (FHLBanks).

The letter reinforces the FHLBanks’ mission to support affordable home ownership and community development in a safe and sound manner. It also includes testimonials of key stakeholders who benefit from the FHLBanks.

The following pages contain the complete content letter (also available as a PDF).

1

The FHLBanks support our communities by providing our members with reliable financing – unlocking credit and home ownership.

Our activities support housing directly, through mortgage programs and housing finance, and indirectly, by accepting housing-related collateral in exchange for liquidity and funding. Most of the eligible collateral pledged to the FHLBanks for member advances is housing-related collateral which ensures our members are connected to the success of the US housing market.

The FHLBanks serve ~6,500 members – including banks, credit unions, insurance companies and CDFIs – across the United States. We play an essential role as a liquidity provider by offering three main products.

Advances: We provide advances to members for their liquidity and funding needs – originating an average of approximately ~$5T a year across the 11 FHLBanks – from 2019-2021.

Letters of Credit: We offer members letters of credit to enable them to secure obligations, principally public deposits from state and local governments, that enable many smaller financial institutions to keep funding within their community. In 2021 we originated ~$880B in letters of credit across the 11 FHLBanks.

Mortgage purchase: We purchase mortgages from members, especially smaller members, which provides them liquidity and helps them manage interest rate risk, prepayment risk, and credit risk. We often act as a conduit for smaller lenders to access Fannie Mae and Freddie Mac. In 2021 the FHLBanks’ purchased ~$21B in mortgage assets across nearly 100,000 loans.

Our liquidity and funding support the unique structure of the United States financial system, where thousands of smaller, community lenders co-exist alongside larger, national institutions. Without access to our funding, financial institutions, particularly smaller ones, would be limited in their ability to lend to the communities they serve and would be more vulnerable to macro-economic shocks.

VOICE OF STAKEHOLDERS: The FHLBank System is a vital liquidity partner to financial institutions around the country, enabling them to provide real impact to their communities.

“The banks were in many ways the unsung heroes of the global financial crisis.”

“If we didn’t have access to FHLB advances, we’d have to hold much more liquidity on our balance sheet and significantly reduce our lending in our communities.“

“As a community banker, I viewed the mission of the Federal Home Loan Bank of Dallas as being that liquidity partner for us in community development.”

“Our Federal Home Loan Bank helps us to manage our liquidity easily with just a phone call.”

“The Federal Home Loan Banks have provided critical liquidity to credit unions, including many smaller community lenders that often do not have access to other sources of low-cost funding.”

In addition to the AHP, FHLBanks offer voluntary programs that create positive impact in their communities. Between 2019-2021, the FHLBanks contributed over $190M to voluntary programs. These programs are tailored to the needs of each district and include support for housing development, homeownership, small businesses, and disaster relief. Voluntary programs have the flexibility to be created and deployed rapidly. In 2020, multiple COVID disaster relief grants were created, including programs that helped members participate in the Paycheck Protection Program (PPP) with confidence.

VOICE OF STAKEHOLDERS: The FHLBank System provides invaluable support to members to offer affordable housing to their communities.

“We’ve used affordable housing program grants in tribal communities for low-income housing tax credit projects, we’ve sponsored five AHP grants, totaling over $2 million.”

“I’m here, first and foremost, to sort of reiterate how important this source of funding AHP program is. For us in our work, I would estimate that approximately half of our developments end up using this resource and it’s incredibly helpful.”

“Through a forgivable down payment program, we were able to assist over 100 families in our communities, with more than a half a million in grants to help them achieve their dream of homeownership.”

“Here in our district since 2012, the Federal Home Loan Bank of San Francisco has funded over 40,000 affordable housing units, and making over 5,000 borrowers achieve the dream of homeownership for the first time.”

2

By performing our core function of providing members with liquidity support every single day of the last 90 years – including as a shock absorber in times of crises – we underpin stability in the US financial system.

Through our access to the debt markets, the FHLBanks can quickly meet the liquidity and funding needs of our members. This enables our members to lend with confidence, knowing they have a source of reliable liquidity when the need arises. Leading rating agencies such as Moody’s recognize the ‘special role’ FHLBanks play in providing liquidity to the financial system, most recently demonstrated in Q1 2020 during COVID market distress.

The FHLBanks were designed to be dynamic through the self-capitalizing nature of member advance activity, expanding and contracting as the needs of member financial institutions and their communities change over time. This scalability was on display during the 2018-2021 period, where advances originated fluctuated by approximately 250% in response to changing needs.

During the Global Financial Crisis, from Q2 2007 to Q4 2008, advances outstanding increased by $258B (40%), helping support many smaller financial institutions. The FHLBanks were the largest source of crisis-related liquidity to the financial system until the Federal Reserve intervened in March 2008.

During the early stages of the COVID-19 pandemic, prior to Federal Reserve and legislative intervention, advances outstanding rapidly increased by $158B (25%) in Q1 2020, the majority of which occurred in the last few weeks of March, 2020 . This shows the “first responder” status we hold in the market, helping create stability and security.

Case Study

FHLBanks stepped in to rapidly respond to address community liquidity and funding needs during the COVID-19 pandemic

“The RISE Program was a tremendous help to our bank as we worked around the clock to keep paychecks in the hands of workers in the communities we serve. Thank you FHLB Cincinnati for helping us help others.”

“Without (FHLB San Francisco), we wouldn’t be in the Paycheck Protection Program.”

The FHLBanks also support their communities when local crises hit. For example, we can offer effective and tailored support in case of natural disasters, such as hurricanes, storms, and wildfires.

Case Study

FHLBank Dallas supported the recovery after Hurricane Katrina

“We were able to help a lot of people with the funding that the Federal Home Loan Bank put out. We wouldn’t be where we are today as a community without the support of FHLB Dallas and so many other people and organizations who opened their hearts and wallets to help.”

3

Our regional structure particularly supports smaller, community lenders – who would be limited in their ability to serve their communities without FHLBanks.

Our smaller members consistently highlight the critical role the FHLBanks play in enabling them to stay competitive and offer credit to their consumers.

VOICE OF MEMBERS: The FHLBanks are a reliable partner to smaller financial institutions

“In times of disruption, having the Bank as a strong partner is even more essential. We’re dealing with pretty significant liquidity issues, and FHLBank San Francisco advances are important to financing on an interim basis – an absolutely necessary step.”

“Advances are an integral part of our wholesale funding strategy. They help us meet both short- and long-term liquidity needs. For decades, our bank has turned to FHLBank Boston for funding because they are a reliable partner and offer ease of execution.”

“[FHLB New York] treated our very small credit union($15 million in assets) and our Board of Directors the same way as they treat any other financial institution. It was a great experience and we are very thankful.”

Case Study

FHLBank Des Moines reaches Native communities with a CDFI partnership

“Thank you to the Bank and the Foundation for helping to build thriving Native economies. Stay with us!“

Our mortgage purchase programs particularly support smaller institutions in lending to their local communities. On average, nearly 75% of mortgages FHLBanks purchase are originated by Community Financial Institutions.

Case Study

FHLBank San Francisco supports housing finance for communities in need for members such as Broadway Federal Bank

“We aim to serve the working poor, and that’s our clientele. If we didn’t have access to the banks and that credit availability, we literally would be out of business.”

Listen to a story from one of our members

The FHLBanks recognize that small businesses are the foundations of our communities and local economic development. Our voluntary programs include small business development grants, discounted advances, and soft/deferred loans that support small businesses in both sustaining and

growing their operations.

Case Study

FHLBank Indianapolis uses its Elevate grant to support small businesses

Case Study

FHLBank Boston created a Jobs for New England (JNE) program to help small businesses create and retain jobs

More than 130 members have applied for at least one of the various JNE programs – traditional, grants, working capital, and other programs since inception in 2016. The total includes 98 members with disbursed or current year approvals from the traditional 0% advance JNE program. JNE advances help to create or retain jobs and expand small businesses owned by women, minorities, veterans, or disabled persons. Ledyard National Bank in New Hampshire used JNE to help a veteran-owned bakery retain 44 jobs.

VOICE OF MEMBERS: Supporting rural members and communities

“Since I came on board at Partnership Housing in 2012, we have completed 350 rehabilitation projects. Those range from $5,000 rehabs to $65,000 rehabs. We partner with dozens of local, state and regional public and private partners, including Federal Home Loan Bank of Cincinnati, and its community lenders. These networks are very vital to our ability to serve our rural population.”

“There is no doubt because of the seasonal nature of the crops we grow, cotton, soybeans, rice, and corn, we could not provide the liquidity necessary for our seasonal demand for funds, which almost doubles during the growing season. The advances we can access at the Home Loan Banks allow us to make longer-term loans for housing, farm equipment, and agricultural land that supports our community.”

“Due to the nature of the ag business cycle, the demand for funding can be inconsistent throughout the year,” said Moore. “We experience a great deal of line usage in the spring and summer, with pay-downs beginning after harvest in the fall through the first few months of the following year. This cycle creates short-term funding needs on an inconsistent basis. FHLBank Chicago provides exactly what we hope to provide to our client base: ease of doing business, responsiveness, fair pricing, follow-up, and support.”

VOICE OF MEMBERS: Support for smaller members such as the People’s Bank of Seneca – a $360 million bank, in Seneca, Missouri

“What makes our bank a little bit unique is that we’re majority owned by the Eastern Shawnee Indian Tribe of Oklahoma… the Federal Home Loan Bank of Des Moines who we’ve worked with, is a true partner. They have been instrumental in our banks survival, instrumental in our bank’s growth, and instrumental in what we’re now doing, which is thriving.”

“We’ve also over the years, worked closely to be a sponsor with several local Native American tribes, as well as some groups that specialize in low-income housing and elderly housing. And we’ve sponsored them, they’ve received grants that have truly made a difference in our communities.”

4

Our support to members helps enhance home ownership through increased mortgage lending by smaller financial institutions, support for new housing construction, and customized voluntary programs.

Purchasing mortgages from members directly promotes lending and supports families throughout the nation to become homeowners. In 2021 we had over 1,000 member or housing associates approved to sell us mortgage assets and we purchased nearly 100,000 loans , with many coming from smaller lenders in rural communities who would otherwise not have the ability to offer these loans or offer them competitively.

“The Mortgage Partnership Finance Program (MPF)® Program is essential to the continued success of our fixed rate mortgage lending program. The flexibility of the products offered, along with the competitive rates are what we value most through our partnership.”

“The MPF Program keeps us competitive in the markets we serve through their unique mortgage products. The fact that we are able to retain servicing is an important feature that allows us to keep that ‘small town bank’ feel as we continue to develop customer relationships.”

The AHP offers grants to fund single-family and multi-family construction and a set-aside program to help future homebuyers with down payments. Since 1990, the AHP has resulted in $7B in grants and subsidized loans nationwide. In 2021, the FHLBanks supported over 30,000 housing units, granting a total of ~$350M through AHP. Since inception, the AHP has supported the creation, rehabilitation, or purchase of almost ~1M affordable housing units, as of 2021 . This has had a profoundly positive impact in supporting communities and vulnerable populations across the United States.

Case Study

FHLBank Atlanta uses CIP to invest in communities

FHLB Atlanta advanced $5M over 3 years to enable preservation of naturally occurring affordable rental housing.

“The CIP rate allowed for a lower cost of capital, which we were able to pass on to the borrower with a dramatically lower rate to acquire these two properties. This was very helpful to the borrower since the projects were the preservation of naturally affordable housing near the Bay area and preserved 58 affordable units. We wouldn’t have been able to provide the borrower with the rate they need to acquire the properties without the CIP advance.”

Case Study

FHLBank Pittsburgh helps create affordable housing for rural communities

Monroe County, West Virginia is rural – there are no stoplights or fast-food restaurants in the entire county. In 2014, seniors represented ~16% of the county’s residents, and most could not afford market-rate rents. A $650K AHP grant was used to help develop 8 units of affordable housing for seniors and individuals with disabilities.

“Bottom line, we could not have done this project without WVHDF [West Virginia Housing Development Fund] and FHLBank Pittsburgh. I cannot say enough about both organizations and their staffs.”

Case Study

FHLBank New York helps create affordable housing for local Seniors

Hearthstone is now home to 92 very low- and low-income seniors, some with physical challenges. The Hearthstone project qualified for AHP funding since the rehabilitation created rental housing specifically equipped for the elderly, where at least 20% of the residents earn at or below 50% of the area median income.

The CIP provides funding to members for targeted community development including housing finance, mixed-use projects, and economic development projects. In the last five years, these advances were used for projects such as converting commercial buildings into low-income rentals, developing condominiums for underserved senior citizens, and creating living centers for at-risk veterans. In 2021, the CIP funded approximately $1.7B in targeted housing and economic development, assisting around 8,000 households.

Case Study

FHLBank Pittsburgh helps Ridgeline Children’s Shelter use the Community Lending Program (CLP) to serve society’s most vulnerable

“The low-interest loan secured by West Union Bank through FHLBank Pittsburgh allowed us to get the funding we required to help more children and families throughout West Virginia with services so desperately needed.”

The FHLBanks provide additional support beyond that required by the AHP, funding voluntary programs supporting homeownership in our communities. These programs offer grants for home repair, down payment assistance, housing development, and housing related service organizations.

VOLUNTARY PROGRAMS: FHLBank Dallas created the Housing Assistance for Veterans (HAVEN) program to help Veterans with housing-related financing

U.S. Army Reserve veteran Jeffery Darrough, pictured here with his wife, Joyce, received a $10,000 HAVEN grant from FBT Bank & Mortgage and FHLB Dallas for home repairs.

“If I had not received the grant, I probably would have had to push back the repairs I needed. There is no way I could have gotten it all done at once. The HAVEN program took my worries away, and it was a tremendous blessing.”

Case Study

FHLBank Atlanta creates innovation in community programs – Heirs’ Property Prevention and

Resolution Funders’ Forum

In December 2021, FHLBank Atlanta hosted the Heirs’ Property Prevention and Resolution Funders’ Forum. This one-day event was designed to facilitate connection between nonprofits and other organizations that presented pilot initiatives and targeted solutions to potential funders for the purpose of addressing and preventing the issue of heirs’ property.

Case Study

FHLB Des Moines helps its community support its disabled homeless population

“For us at the Eden Village, an organization dedicated to tackling homelessness, we simply wouldn’t be able to do what we do without FHLB Des Moines’ help. Our community of Springfield, Missouri, had long lacked the infrastructure needed to properly serve its homeless population. So, in 2010 our founders, a group led by Linda, my wife, and me, decided to tackle it head on. That’s when the idea for Eden Village was born – an idea that wouldn’t have gotten off the ground without an AHP grant from FHLB Des Moines in partnership with The Central Trust Bank. FHLB Des Moines “bent over backwards” to make sure we completed our application correctly, and sure enough we received $750,000 to build our first Eden Village.”

5

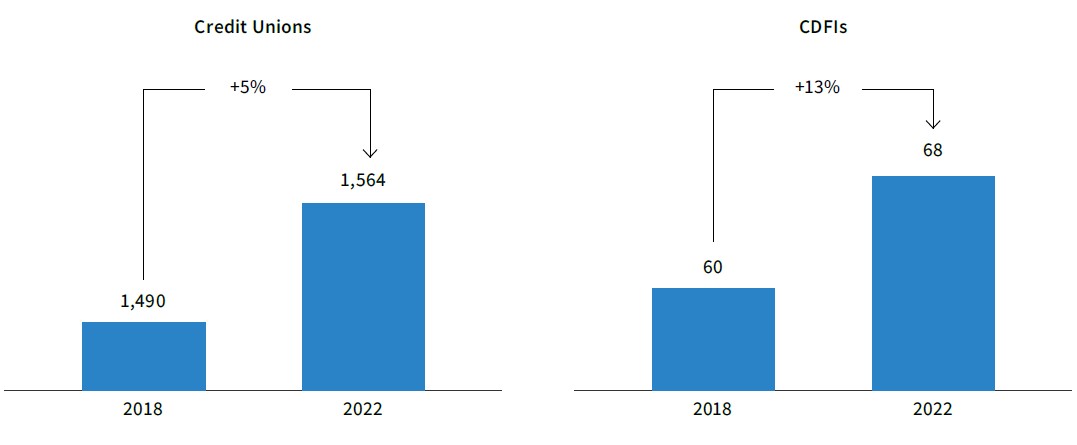

The diversity of our current membership – across different types and sizes of regulated financial institutions – creates stability and resiliency for the FHLBanks and supports scaled contributions to the Affordable Housing Program and other voluntary programs

Membership diversity is important across different economic cycles as our members’ funding needs meaningfully change. In March 2020, the greatest period of uncertainty in the COVID-19 crisis, depository institution advances outstanding declined sharply, but were partially offset by insurance company advances outstanding increasing by 16%, helping the FHLBanks operate consistently through this volatile period. Throughout the rest of 2020, depository institutions’ demand for advances decreased as their deposits increased, while advance demand from insurance company members increased.

6

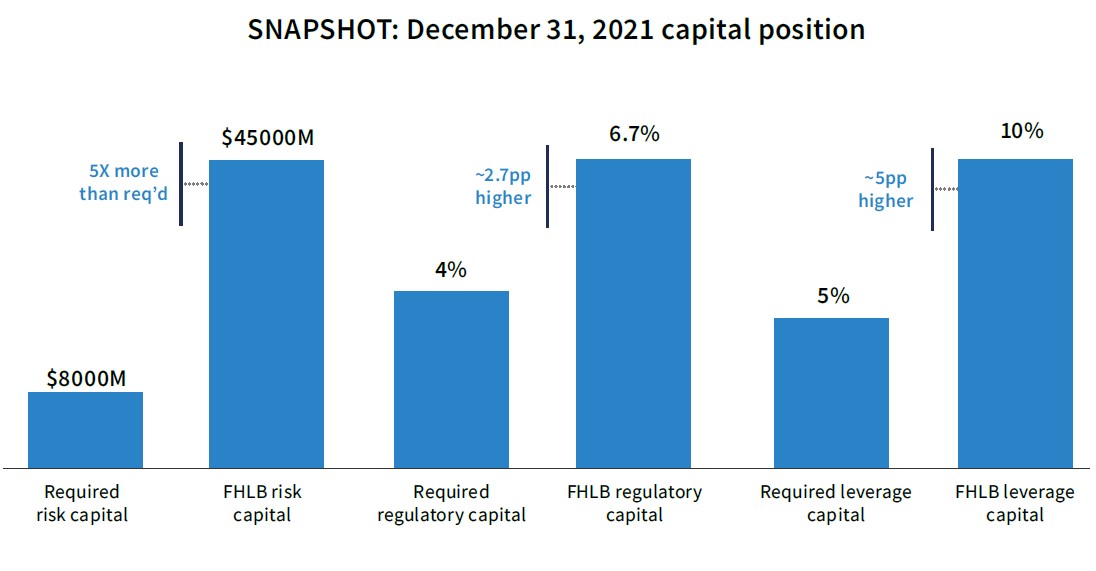

As government-sponsored enterprises, the FHLBanks’ self-capitalized structure, rigorous approach to risk management, strong governance, and independent oversight by the FHFA, underpin our position as responsible stewards of a competitive debt franchise

The FHLBanks have multi-layered governance structures made up of seasoned management teams, Boards of Directors (including member directors and independent directors), Affordable Housing Advisory Councils, and risk committees for each individual FHLBank and the system as a whole. This structure enables the FHLBank System to navigate the changing marketplace while delivering on its mission.

7

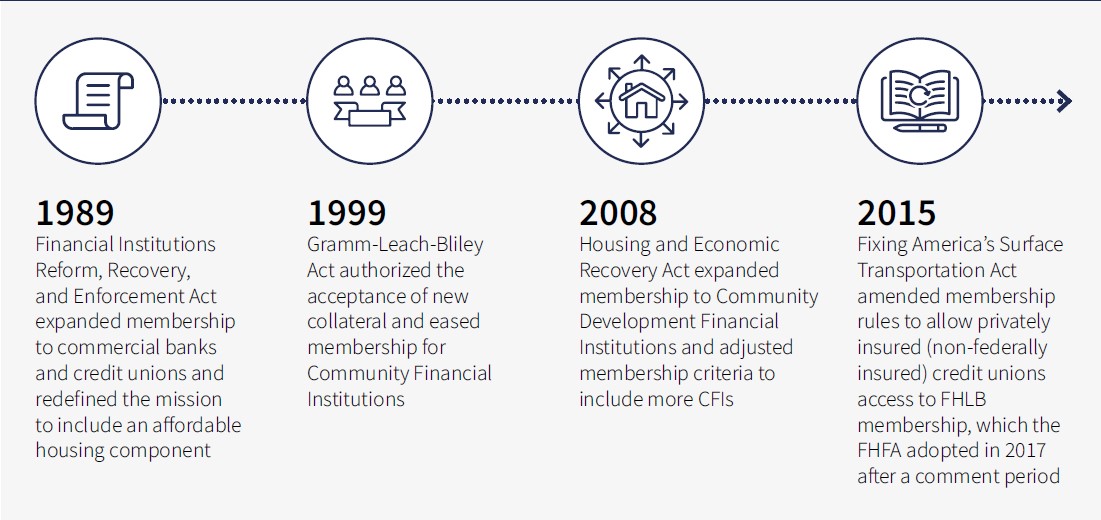

Our members and their needs have evolved, and we have evolved to serve them, with support for new processes and technologies, changes to accepted collateral, and progress on diversity, equity, and inclusion

LEGISLATIVE TIMELINE: Changes to FHLBank system

We have been a financial markets leader, including through the switch from the London Inter-Bank Offered Rate (LIBOR) to the Secured Overnight Financing Rate (SOFR), where we helped set the standards and timelines in industry groups such as the Fed’s Alternative Reference Rate Committee and the Swaps and Derivatives Association. Since 2018 we have issued over $700B of SOFR linked debt, one of the leading financial institutions in these types of products. Additionally, in recognition of our members’ increased usage of digital loan technology, we created acceptance requirements and guidelines to standardize processes for members. This enabled the FHLBanks to begin accepting eNotes (i.e., mortgage loans that have an electronic signature and that can be legally transferred) as an eligible form of collateral from our members in 2021.

Evolution requires investment and the FHLBanks have made significant investments of time and money to enhance our member experiences and strengthen the resiliency of our technology. Across the FHLBanks we are deploying technology services like automated mortgage collateral submission, automated securities pledging, dynamic reporting dashboards, API integrations connecting data between multiple applications, and enhanced

online member portals.

FHLBanks have also invested significant resources to expand our support for diversity, equity, and inclusion, with education roadmaps and commitments to fostering diverse supplier and business networks through various programs and initiatives. We have also created meaningful opportunities through our diverse dealers program, which currently has 20 participants, such as increased access to our debt programs, focused sales training, and co-marketing programs with investors. From 2012 to 2021 diverse dealer bond issuance increased by 633%.

Case Study

FHLBank Topeka hosts a diverse supplier fair connecting businesses and creating impact

“The FHLBank (Topeka) has always been sort of a leader in that area. Whenever I have a program coming up that has to do with diversity and inclusion, I will call on them because they set the standards for this community.”

8

Our regional, yet lean structure provides deep links to local communities with leading efficiency levels. We maintain the expertise needed to deliver a leading mission-focused franchise that meets our members’ needs by recruiting and retaining purpose-led employees

One of our key assets are FHLBank employees.

They enable us to run an efficient operating model and provide the expertise needed to deliver a leading debt franchise that meets the liquidity and funding needs of our members, while maintaining our focus on risk and resiliency. Our employees are purpose-driven and have expertise in serving our members through all economic cycles, including financial crises like the Global Financial Crisis and the COVID Pandemic. The FHLBank teams bring a higher-than-average expertise; our average tenure of staff is over ~9 years compared to over ~5 years in the finance industry .

CONCLUSION: Charting a course for the future

The FHLBanks are grateful to the FHFA for the opportunity to participate in this review, and to hear from our members and broader stakeholders in the home finance ecosystem. We look forward to learning from the listening sessions and roundtables, and using these learnings to chart a course for the future. The FHLBanks have evolved over time, and we will continue to evolve to fulfill our mission.