Letters of Credit

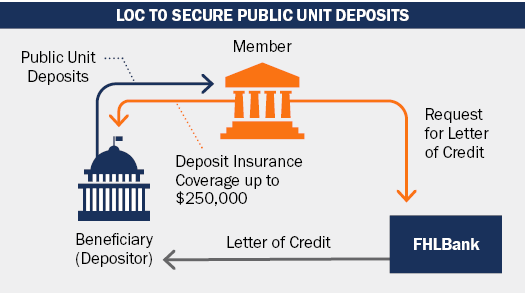

In addition to advances, the FHLBanks also issue Letters of Credit (LOC) on behalf of their members. LOCs represent a promise, made at the request of a FHLBank member, to make payments to a third-party beneficiary in the event of a default of performance. LOCs are used by FHLBank members to support their liquidity needs, asset-liability management, and housing, community, and economic development.

LOCs provide members with a means for guaranteeing contracts and obligations on behalf of themselves and their customers. LOCs are secured by the pledge of high-quality mortgages, mortgage-backed securities, and other collateral generally on equivalent terms to that required for advances.

LOCs are offered with a variety of terms, typically from as short as two weeks to up to 180 months. Fees are quite competitive. Members are most commonly charged a combination of an upfront and period fee for LOC commitments. Effective costs for typical standby LOCs range from 5 to 25 basis points per annum, with pricing varying based on amount and maturity. Specialized LOCs can require a higher fee that depends on structure, direct payment, maturity and other features.

If an FHLBank is required to make payment for a beneficiary’s draw, the member either reimburses the FHLBank for the amount drawn or, subject to the applicable FHLBank’s discretion, the amount drawn may be converted into a collateralized advance to the member. However, standby letters of credit usually expire without being drawn upon.

On a consolidated basis, the FHLBank System had a total outstand LOC balance of over $203 billion as of December 31, 2023.

FHLBank members use LOCs to support public unit deposits (PUDs), provide credit enhancement to certain transaction types, and to support payment obligations to third parties.

PUDs allow banks and credit unions of all sizes to attract deposits in excess of FDIC insured deposit limits. PUDs are frequently a product of state law requiring collateralization for deposits above the FDIC limit and are distinguished by whether LOCs issued by an FHLBank qualify as acceptable security. PUDs can typically only be secured by the pledge of U.S. Treasury or other similar credit collateral.