Fact Sheet: Advances

FHLBANKS: A RELIABLE SOURCE OF LIQUIDITY IN ALL ECONOMIC CYCLES

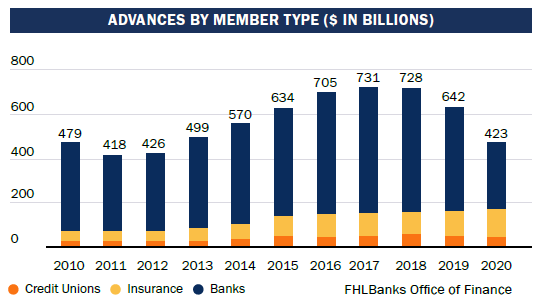

Each year, the 11 Federal Home Loan Banks (FHLBanks) provide access to billions of dollars in lowcost funding to nearly 6,700 of America’s banks, credit unions, insurance companies and community development financial institutions to support homeownership, rental housing, small business lending, and community investment in all credit environments. These FHLBank members rely on this steady flow of funds (or “advances”) to keep communities vibrant and growing in all credit markets.

FHLBank Advances Provide Members with a Secure, Low-Cost Source of Funding

Over its 90-year history, the FHLBanks have provided critical liquidity to community financial institutions that often do not have access to other sources of low-cost funding in stressed conditions. FHLBank loans to members – called “advances” – enable smaller financial institutions to obtain low-cost funding at similar terms as their larger counterpart because of the FHLBanks’ access to the capital markets. FLHBank advances provide liquidity for larger institutions, which are the nation’s largest providers of mortgages and other forms of consumer credit. And FHLBank advances enable insurance companies to more effectively manage risk on their balance sheets by supplementing or replacing other types of financial products.

FHLBanks Perform Well in Uncertain Times

In the 2008 and 2020 crises, the FHLBanks were lenders of first resort and stepped up to keep liquidity in the market when other funding sources dried up. In 2008, the FHLBanks provided about $400 billion of additional funding to member institutions, increasing the total amount of outstanding advances from approximately $600 billion to over $1 trillion. Similarly, at the start of the pandemic in early 2020, FHLBank advances increased by almost $190 billion from approximately $615 billion to over $805 billion. In both cases, the FHLBanks met unprecedented funding demands from member financial institutions when they needed it the most, and before injections of fiscal stimulus by the Fed.

The FHLBanks are low-risk, well-capitalized, financially strong institutions. Working with their members, the 11 FHLBanks support every community of the country every day – and do so in a safe and sound manner. The FHLBanks are a model that works.