Letters of Credit

A LIQUIDITY TOOL

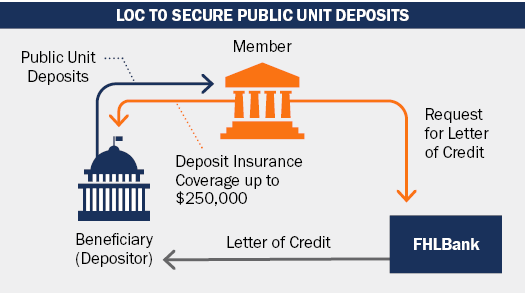

As a key partner in financing, the Federal Home Loan Banks (FHLBanks) issue Letters of Credit (LOC) on behalf of its members to support liquidity, asset/liability management, and housing, community, and economic development activities. A LOC is a promise, made at the request of an FHLBank member, to make payments to a third-party beneficiary in the event of a default of performance.

Support for FHLBank member obligations

- Allowing members to benefit from the additional yield on mortgage or other collateral, relative to the yield on U.S. Treasury securities, increasing their net interest margin;

- Facilitating the retention of municipal and state funds within their respective communities to help support lending and other banking activities;

- Allowing smaller financial institutions to compete on a level playing field; and

- Decreasing responsibilities and associated risk of complex collateral management activities.

- Support public unit deposits (PUDs)

- Provide credit enhancement to certain transaction types

- Support payment obligations to third parties

Public Unit Deposits

This feature is frequently a product of state law requiring collateralization for such deposits and distinguished by whether LOCs issued by the FHLBanks qualify as acceptable security. Such funds can typically only be secured by the pledge of U.S. Treasury or other similar credit collateral.

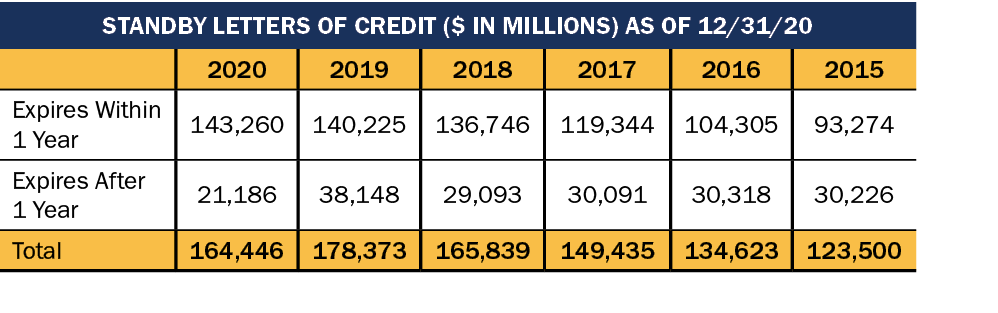

On a consolidated basis, the FHLBank System had a total outstanding LOC balance of $164 billion at year end 2020. The System total has increased on an average of 10% YoY since 2015 (see table).

LOCs are an important product for FHLBank members as measured by usage relative to other products. For instance, from 2015-2020, on a consolidated basis, the notional balance of LOCs relative to total advances has increased from 19% to 39%. Over 1,500 members across the System are currently using a FHLBank LOC product. More than 75% of these members use the funds to secure PUDs.

LOCs are offered with a variety of terms, typically from as short as two weeks to up to 180 months. Fees are quite competitive. Members are most commonly charged a combination of an upfront and period fee for LOC commitments. Effective costs for typical standby LOCs range from 5 to 25 basis points per annum, with pricing varying based on amount and maturity. Specialized LOCs can require a higher fee that depends on structure, direct payment, maturity and other features.

LOC Benefits for Members

- Liquidity – Unencumbers pledged securities to support liquidity objectives

- Efficiency – Lessens monitoring with a fixed notional amount that is not affected by market fluctuations

- Availability – Leverages existing FHLBank collateral, with same-day issuance in most instances