Insurance Companies:

Growing Appreciation for the Value of FHLBank Membership

Insurance Companies Increasingly Utilizing FHLBank System

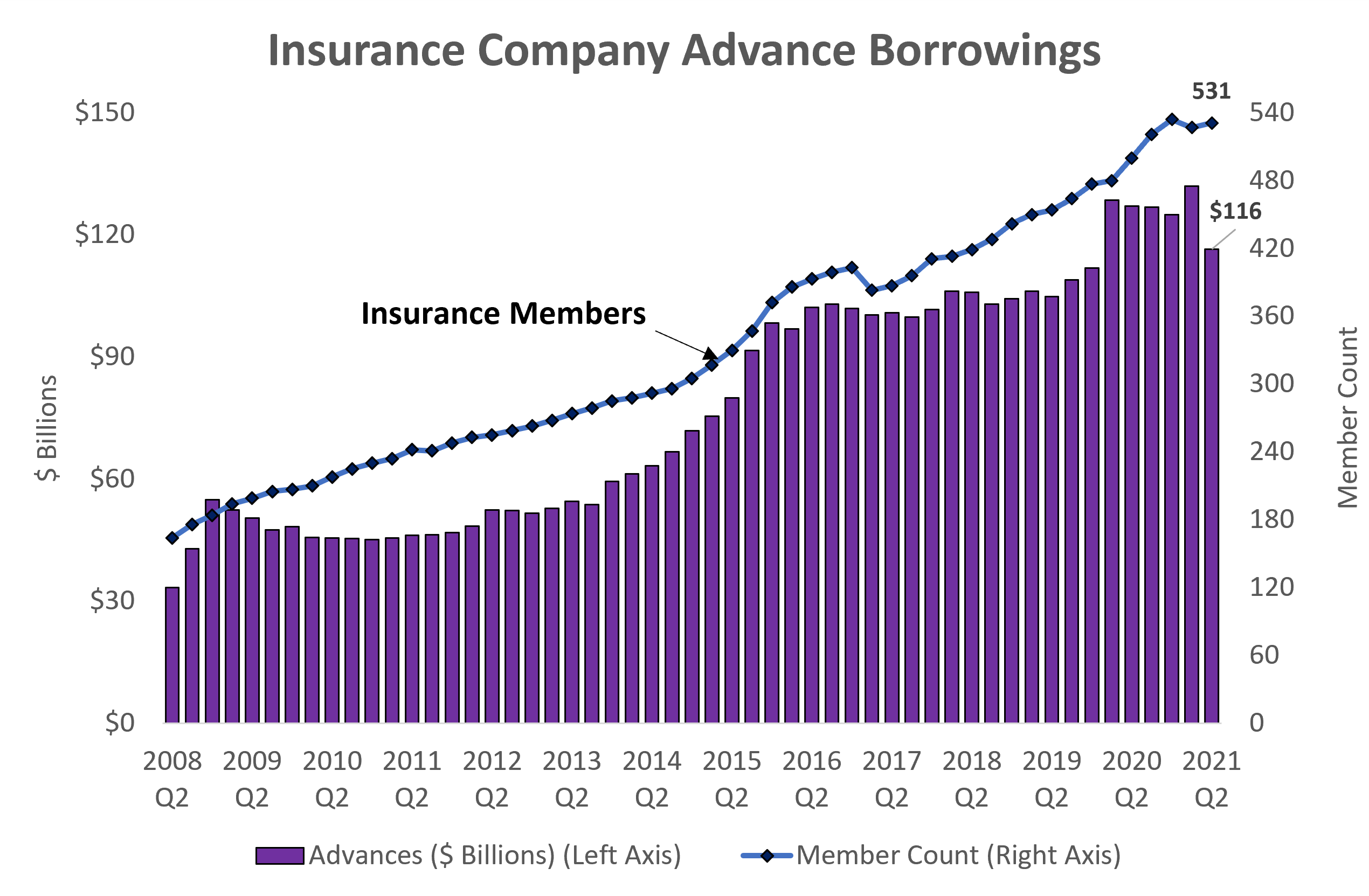

- Insurance company members have grown steadily over the last decade

- While total insurance membership of 531 represents approximately 8% of total FHLBank membership the use of advances is higher – with $116 billion outstanding at the end of Q2 2021, which represents over 31% of total advances of $370 billion

- Advances provide insurance company members a reliable source of competitively priced funding alternatives across a wide range of maturities for liquidity and asset liability management needs

Eligibility for membership in the FHLBank system requires a participating institution to be subject to rigorous oversight and regulatory regime in addition to requiring participation through subscription to FHLBank capital stock.

Insurance Companies are regulated by state insurance departments. State legislatures enact legislation that provides the regulatory framework under which insurance regulators and companies operate. The National Association of Insurance Commissioners (NAIC) is the U.S. standard-setting and regulatory support organization that is created and governed by the chief insurance regulators of the 50 states, District of Columbia and five U.S. territories. Through the NAIC, state regulators establish standards and best practices, conduct peer review and coordinate their regulatory oversight.

The NAIC Capital Markets Bureau monitors developments in the capital markets globally. In February 2021 it published a primer explaining how insurance companies can take advantage of capabilities provided by the FHLBanks. On May 21, 2021 it published an updated analysis of insurance company exposure to the FHLBank system and the diverse range of participation across various insurance company sectors.

On April 26, 2021 Standard & Poor’s Capital IQ Market Intelligence Analyst Tim Zawacki published an analysis of the implications of insurance sector participation in the FHLBank system. The analysis provided an updated view of insurance company participation in FHLBank advance programs, which was published on April 27, 2020.

S&P takes note of the strength and characteristics of demand for advances from the insurance sector. On a relative basis demand from depository members, including banks and credit unions, have plummeted due to a significant build-up of deposits as a consequence of fiscal and monetary policy designed to offset the impact of the COVID pandemic.